So you’re a college graduate that just secured a full-time job and now more money is rolling in than you’ve ever been responsible for. You’ve heard horror stories about how new-found financial freedom can suddenly turn into a nightmare with just a couple of wrong decisions. This blog post doesn’t cover obvious problems like driving up credit card debt but instead describes some fundamental principles to guide you.

Warning: I am not a certified financial advisor/planner. I’m just a guy that has done well with my own personal investments and has had the benefit of passing advice to three daughters when they graduated from college and got their first jobs.

Know where your money is going

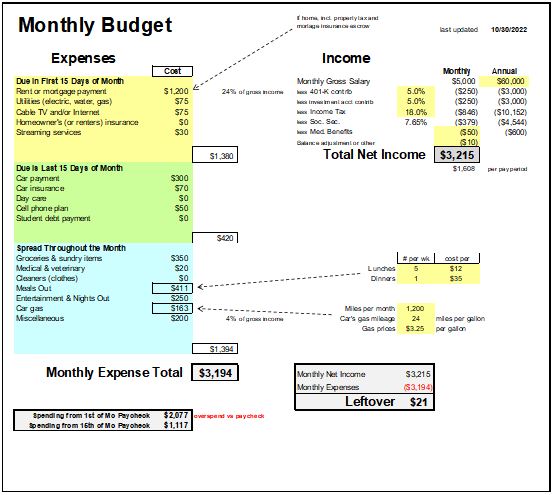

At least at a category level you should know where your money is going. That means creating a budget of your monthly expenses. Then compare your actual expenses versus your budget every 2-3 months for the first year and every year or so after that.

If you think your budget is solid, yet you end up short more than 25% of the time before pay periods, you must find out the reason. Often times, it’s the “miscellaneous” category. Either increase that budget line item until you come to a balance or get more disciplined with your miscellaneous spending.

Also, any specific category in which you’re spending $50 or more per month should be a line item in your budget rather than lumped into “miscellaneous”.

If you don’t already have a good spreadsheet model to use for your budget, download mine here. (or looks like the image you see below).

Maintain at least 6 weeks worth of living expenses in savings in case of job loss

The way to think about it is what would happen if you suddenly lost your job and had to immediately start looking for a new one? How long would it take (best case, worst case, most likely)? How much will health insurance cost until you can get covered under a new employer’s plan (remember, you usually have to pay the whole amount, including what your employer was previously paying, even if you elect what’s called COBRA coverage from your prior employer)?

I usually recommend at least 6 weeks of emergency savings for entry-level employees, 8 weeks for first-line managers, and 10-12 weeks for senior managers and directors. Your budget should tell you how much you need to span this period.

Plan for financial surprises, they will happen more often than you think

Miscellaneous needs that are less than about $50 each should be covered under your monthly “miscellaneous” budget. But beyond that, you will likely find more than once per year something in the $250+ range comes up. So plan for it by having money set aside. If this takes your job loss safety net below where it should be, start building it back up as soon as possible.

In the extreme case, think about a car wreck that causes the insurance company to “total” your car and suddenly you to have come up with a $2,000 for a down payment on a new car. You would want to be able to get your hands on this amount of money immediately, otherwise go without your car for a while.

Invest 10% of your income into a regular investment account (not your retirement account)

This is the account that you will draw from when you want to take big vacations, make a down-payment for a house purchase, put your future kids thru college and is also what you would use if you are able to retire before you turn 60 and will have access to your IRS-guided retirement savings.

Have this regular contribution deposited directly from your paycheck rather than manually transferred each month. If you have your full paycheck deposited into your checking account, it’s amazing how often you’ll either forget or will convince yourself to transfer less than 10% to your investment account.

If you can’t afford to start with a 10% deduction for this, start with a smaller amount and then increase it with each future pay raise until you reach 10%. This investment account should probably be invested in something like an allocation fund, which has a mix of investment types and typically has a name that describes how conservative or aggressive it is. A certified investment professional or experienced family member should be able to guide you on this part.

With every pay raise, add 1-2% to your 401K contribution – until you are contributing at least 10%

This is your retirement account and it will grow tax-free. If you can start out contributing at least 5%, that’s a decent start. And it’s not often that unreasonable if you’re just coming off of a very low budget and feeling like you’ve suddenly got so much extra income.

If you can start out at 8-10% contributions, that’s even better. The cool thing is that most employers allow you to change your contribution on a monthly or quarterly basis, so I recommend starting on the high side of what you think you can afford. You can always dial back if you realize you were overly aggressive.

It will seem like your investment balance grows very slowly at first, but once the balance increases to something more substantial, the gains on your base amount will really start to compound. So be patient.

- If your employer doesn’t offer a 401K plan, then have this money automatically transferred into your own personal Individual Retirement Account (IRA). It will still grow tax-free, and your contributions might also be tax-deductible until you reach higher income levels. Educate yourself on Roth versus traditional IRAs to decide which is best, because the rules change over time.

- Realize that IRA and 401K accounts are something that you won’t want to touch until you’re at least 60 years old. Otherwise, you’ll incur a tax penalty for the early withdrawal. Most 401K plans allow taking a loan against your balance at a very favorable interest rate and when you make payments you are essentially paying yourself back. So that’s a possible fallback in case of a financial emergency.

The Magic of Compounded Growth

Here’s an example of how regular deposits into an investment account can grow over a 20 year period. Down the left side are different monthly deposit amounts and across the top are different investment returns you might expect to get in the stock/bond market.

Most likely, your monthly deposit amounts will increase over time, but this analysis will show you just how valuable the concept of compounded growth is. You will reach a point where your saved money is really working for you.

| Monthly Deposit |

6% Return |

8% Return |

10% Return |

| $100 |

$46,435 |

$59,294 |

$76,570 |

| $200 |

$92,870 |

$118,589 |

$153,139 |

| $500 |

$232,176 |

$296,474 |

$382,848 |

| $1,000 |

$464,351 |

$592,947 |

$765,697 |

In order to retire and live for 20 years from your retirement account, you will need a lot more money than most people think. In fact, having $1 Million in your retirement account will only allow you to draw $86,000 per year, assuming you can continue to get a 6% return on your investments during retirement. I know, that might sound like a lot of money to you today. But 40 years from now when you’re ready to retire, inflation will cause that to only be equivalent to about $26,000 in today’s dollars (assuming 3% inflation). You might be able to count on Social Security to add to the amount and you might inherit something from a family member, but be very careful about counting on either of those scenarios.

Disability Benefits

If your employer offers a benefits plan, check to see if long-term disability is included. And even if it is, check to see how much of your salary it pays you and for how long.

What would happen if you were to be disabled from an accident or severe medical condition and couldn’t continue working a job that pays enough for you to be self-sufficient? Long-term disability benefits provide you income for a long time (varies depending on the plan) and the cost for young working professionals is usually VERY inexpensive (think $5-10 per month). I personally believe this is MUCH more important than life insurance, which becomes really important if you later have children that are dependent on your income.